Slow and Steady: Juvia’s Place vs. Everyone Else

What does it mean when the brand the industry ignored for seven years just threw the biggest celebration of beauty in New York City? Juvia’s Place has no investors, no celebrity halo, and still it wins.

A Night That Changed the Math

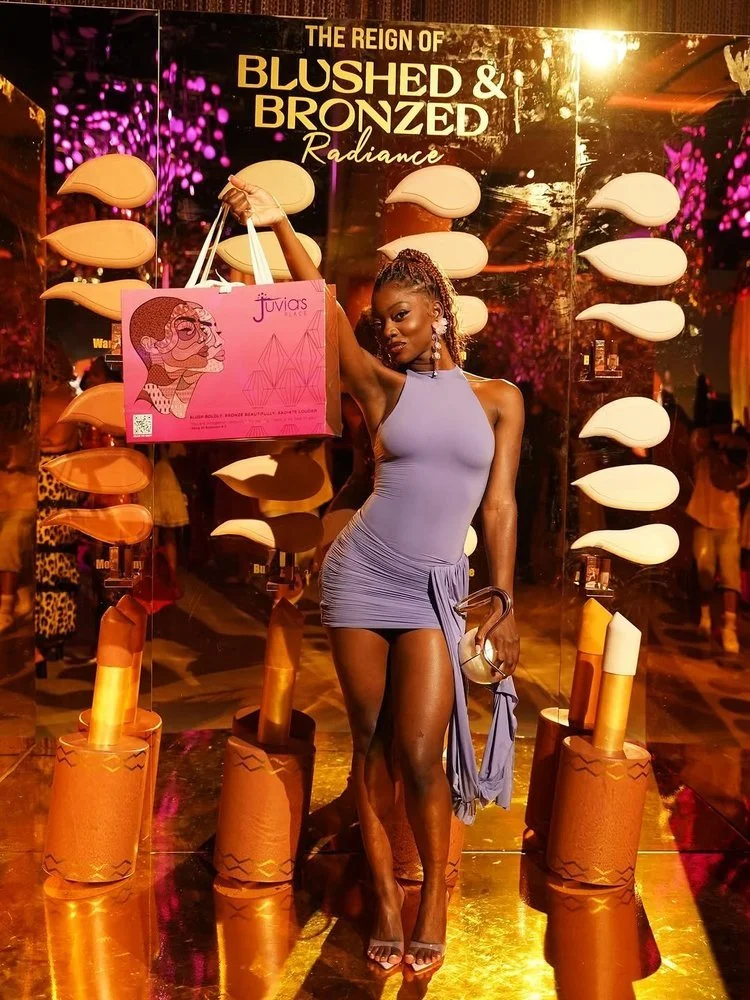

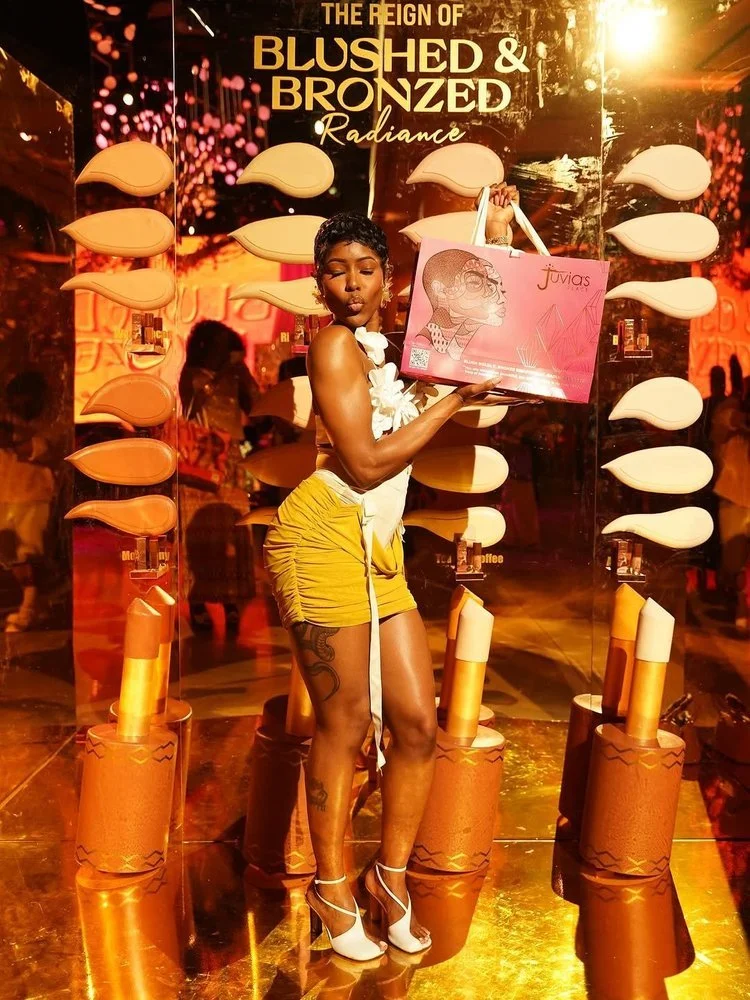

On August 24th, Juvia’s Place pulled off what no one saw coming: the party of the year in New York City. The Reign of Blushed & Bronzed Radiance wasn’t sponsored. It wasn’t co-signed by a global celebrity. It wasn’t a victory lap after a billion-dollar valuation. It was a brand, its community, and a city lit up in pink, gold, and joy.

And yes…I wasn’t there. I was crushed to miss Davido’s performance. But the flood of posts from Black beauty lovers and creators told the story: this wasn’t a brand “testing” IRL. This was Juvia’s Place showing us what seven years of deliberate building looks like when it takes physical form.

When the Industry Slept

Here’s the truth: the mainstream beauty industry has never really known what to do with Juvia’s Place.

This is a brand that:

Turned $2,000 seed money into a multi-million dollar global indie.

Launched 42 shades of foundation in 2019, before “shade range” was a press release bullet point.

Rolled out a $300K small business grant in 2020 (six founders, $50K each), one of the largest indie brand community investments of that year.

Generated $158M in Earned Media Value in 2019–20, then held steady at $86M in 2022 without a cent of venture backing.

And yet? Minimal coverage. That grant barely made a ripple beyond Allure. Seven years in, no Business of Fashion feature. Meanwhile, brands with shinier celebrity halos or smaller gestures are anointed as “the future of beauty.”

So what does it mean when the brand that the industry overlooked just pulled off the party everyone’s still posting? Maybe that press isn’t the pulse we pretend it is. Maybe visibility ≠ validity.

The Sprint vs. the Stamina

Cécred: Beyoncé plus Ulta equals cultural juggernaut. Scale overnight, headlines on tap.

Pattern Beauty: Tracee Ellis Ross’s steady curl empire. Disciplined, consistent, built with retail muscle.

Mielle Organics: Community credibility supercharged by P&G’s acquisition. Super Bowl ads don’t come from bootstraps.

Glossier: Once the face of millennial beauty, now a Sephora tenant, a cautionary tale of hype without discipline.

Morphe: The influencer rocket ship that crashed, filing for bankruptcy in 2023.

Rare Beauty: Selena Gomez’s $400M engine, built on celebrity glow and Sephora dominance.

And then there’s Juvia’s Place. No VC millions. No celebrity founder. No corporate parent. Just pigment-rich palettes, accessible price points, Ulta distribution, and a community that has carried it on their backs for nearly a decade.

The Business Behind the Glitter

Juvia’s didn’t scale by flooding the market with a dozen categories or bending to investor KPIs. It stayed tight:

Complexion (42 shades of foundation).

Color (eyeshadow palettes that still go viral).

Pricing that undercuts prestige but overdelivers on payoff.

Ulta shelves and bundles online that drive steady sales.

That NYC event wasn’t indulgence, it was a business strategy. Why spend six figures on a billboard when you can invest in creators who will flood TikTok and Instagram with content? Why wait for the press to cover you when you can make your own headline?

Why Juvia’s Place Wins Anyway

Juvia’s Place proves the beauty playbook doesn’t have to be VC money, celebrity clout, or corporate buyouts. It can be slow, steady, and stubbornly independent, and still create moments so spectacular that the establishment can’t ignore them anymore.

And if you’ve been supporting this brand since the Nubian Palette days, you know: it’s not about patience. It’s about payoff.