Here’s to Ami Colé: Backing Black Beauty Builds Better Beauty for All

We all squeezed the last drop out of that Lip Treatment Oil. We all chased that skin tint glow. Ami Colé wasn’t “for Black people only”; a Black founder built it to solve shade reality, and the results looked good on everybody. Yet the brand will close in September 2025 because the money, margins, and post‑DEI market didn’t match the love. One brand’s wind‑down cannot be used as shorthand to underfund an entire category.

Here’s the short, readable download: what happened, why it matters for investors and shoppers, and how to protect Black‑founded brands we all use.

The Beautiful Journey

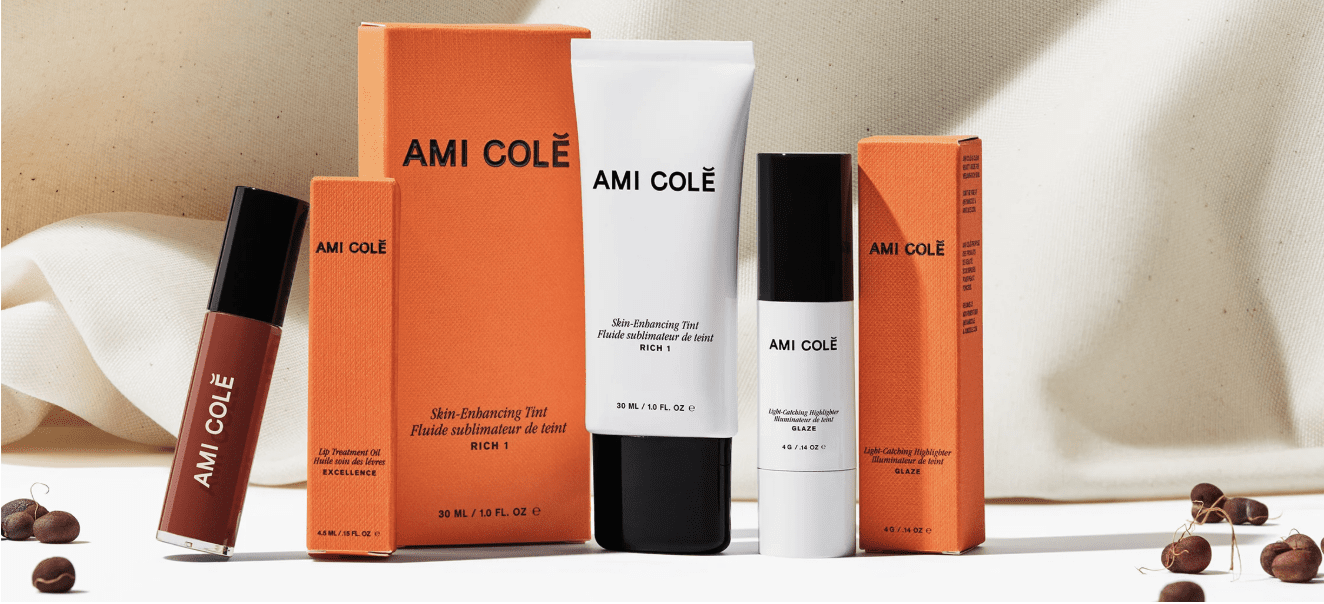

Launch 2021; community‑built. Founder Diarrha N’Diaye‑Mbaye surveyed 400+ people to get undertones right and launched three hero products: Skin‑Enhancing Tint, Lip Treatment Oil, and Light‑Catching Highlighter. Early runs sold out.

Cred doors first. DTC momentum plus selective placements (Thirteen Lune, Violet Grey, Net‑A‑Porter, Goop) built trust before going wide.

Sephora sprint. In under two years, the brand jumped from a few hundred to ~600 U.S. Sephora doors as buzz and investor optimism pushed scale.

L’Oréal BOLD stake. A strategic minority investment, L’Oréal’s first early‑stage bet on a Black‑founded brand with a Black core consumer, was meant to fuel rollout. Amount undisclosed.

Sub‑$10M band. By early 2025, industry reporting grouped revenue below $10M even as distribution stretched across ~590+ offline points.

Closing Sept 2025. After a “soul‑stretching” effort, the founder said continuing in the current capital + retail climate wasn’t sustainable. Love wasn’t the issue.

Why It Closed Isn’t Complicated

1. Scale outran cash. National prestige distribution demands inventory, freight, trade spend, samples, and staff education.

2. Not enough marketing muscle. Conglomerates pay for gondolas, sampling programs, cast education days, and digital boosts that drive velocity. Indies can’t fake that spend; discoverability suffers.

3. Funding flipped. The post‑2020 “invest in Black brands” energy cooled; by 2024 investors wanted profitability and door‑level POS proof. Funding flowing to Black‑founded beauty shrank sharply as the wider beauty funding market contracted.

4. DEI pullback shrank the safety net. Big‑box enthusiasm for BIPOC programs ebbed; less marketing and on‑ramp support increased risk just as emerging brands needed it most.

5. Margin squeeze signals. Viral hero today, markdown tomorrow; promotional pressure erodes gross margin exactly when cash is needed for reorders.

The One‑Brand Burden (Let’s Kill It)

In beauty, when a well‑loved Black‑founded brand struggles, gatekeepers too often read it as “the market isn’t there.” That lazy pattern starves everything behind it. Ami Colé shows the opposite: the market showed up; the infrastructure didn’t. Investors: don’t use one wind‑down as cover to de‑risk the entire inclusive category you marketed support for in 2020. Shoppers: keep buying Black — those receipts matter in boardrooms.

Protect Black Beauty Brands (Smart, Simple Play)

1. Pace Your Doors. Only add retail doors when current ones turn, and you’ve budgeted inventory + trade spend. No cash, no doors. (Ami Colé’s sprint = caution.)

2. Price the Shelf Before You Sign. Ask what gondolas, endcaps, samples, and cast education cost. Negotiate phased support or pooled inclusion funds if you can’t pay upfront.

3. Plan for Spikes and Slumps. Viral product today, markdown tomorrow. Pre‑plan bundles/GWPs so promos grow lists, not just drain margin. (Lip Oil discount tells the tale.)

4. Tie Growth Goals to Funded Money. Don’t promise new doors, shades, or hires without a committed tranche wired. Investor mood changed; update your deck and milestone math.

5. Stack Capital + Care. Mix equity, grants, venture debt, and revenue‑share for inventory cycles and budget ops support so the founder doesn’t burn out holding the whole thing.

Money & Merch: Your Move

Investors: Equity without operating capital is performative. Pair checks with working‑capital lines + activation budgets; insist on door‑level POS so you can help fix velocity, not just judge it. Stay past the DEI press release.

Retailers: Phase‑gate rollouts; co‑fund inclusion sampling/education; share real‑time sell‑through + shade data so emerging brands don’t drown in markdowns. If you say you serve all shoppers, fund the brands that do.

Support Black Beauty = Support Better Beauty (For Everyone)

Buying Black isn’t charity; it funds formulas, undertone ranges, textures, and narratives that improve the whole aisle. When Black-founded brands win, shade systems get smarter for light, medium, and deep — for all of us. Keep the receipts flowing.

Show Up & Toast: Support Black Beauty Now

Buying Black isn’t charity—it’s how better formulas, fuller shade grids, and culture‑driven storytelling reach every shopper. Keep buying, posting empties, tagging retailers, and asking where the inclusive brands are stocked. Your receipts matter in boardrooms.

Get Involved:

Capital & Connections Clinics – quarterly matchmaking across grants, venture debt, and angels who get inclusive growth.

Retail Accountability Watchlist – tracking who backs inclusion beyond statements. Interested? Email team@theblackbeautyclub.com